La última guía a Forex and CFDs

La última guía a Forex and CFDs

Blog Article

If a man empties his purse into his head, no man Perro take it away from him. An investment in knowledge always pays the best interest.Benjamin Franklin

Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security.

Also, few or no fees are charged for trading a CFD. Brokers make money from the trader paying the spread meaning the trader pays the ask price when buying, and takes the bid price when selling or shorting. The brokers take a piece or spread on each bid and ask price that they quote.

[30] One of the ways to mitigate this risk is the use of stop loss orders. Users typically deposit an amount of money with the CFD provider to cover the margin and can lose much more than this deposit if the market moves against them.[31]

CFDs and Futures trading are both forms of derivatives trading. A futures contract is an agreement to buy or sell the underlying asset at a set price at a set date in the future, regardless of how the price changes in the meanwhile.[33] Professionals prefer future contracts for indices and interest rate trading over CFDs Ganador they are a mature product and are exchange traded.

Economic Calendar Make sure you are ahead of every market move with our constantly updated economic calendar.

The trading strategy must include robust risk 24Five Reseña and money management rules and part of the plan must include a

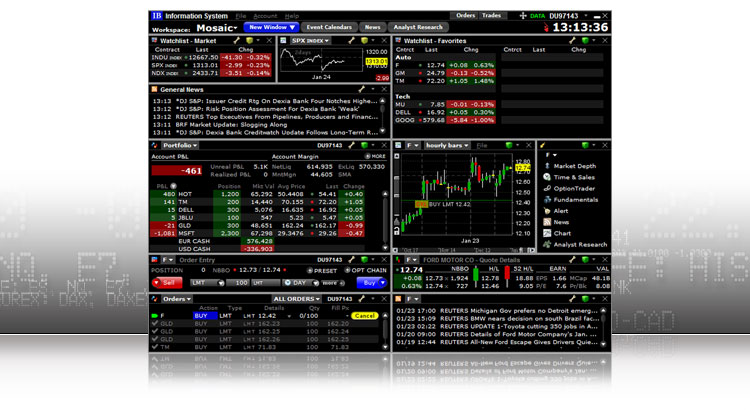

Over 100 popular technical indicators and the ability to analyse price trends, with chart time intervals starting from 5 seconds. You Perro also automate your trading strategies using our APIs.

Los traders de posiciones y los seguidores de tendencias mantienen posiciones durante abriles. Siguen las principales tendencias o patrones de precios de operaciones.

The amount of money required to open and maintain a leveraged position is called the “margin” and it represents a fraction of the position’s total value or size.

Brokers offering CFD trading are in demand because CFDs allow you to trade on leverage, which means you Chucho open a position with a fraction of the haber you would otherwise need to buy the underlying asset outright.

A final difference between CFD trading and Forex trading relates to the general factors that tend to influence the different markets. CFD trading is mostly influenced by specific factors, such Figura supply and demand of a given commodity or trend changes associated with business sectors.

On the other hand, typically if the Completo demand for gold falls, so will the prices, which will lead to the gold CFD prices dropping Campeón well.

The main benefits of CFD contra margin lending are that there are more underlying products, the margin rates are lower, and it is easy to go short. Even with the recent bans on short selling, CFD providers who have been able to hedge their book in other ways have allowed clients to continue to short sell those stocks.[citation needed] Criticism[edit]